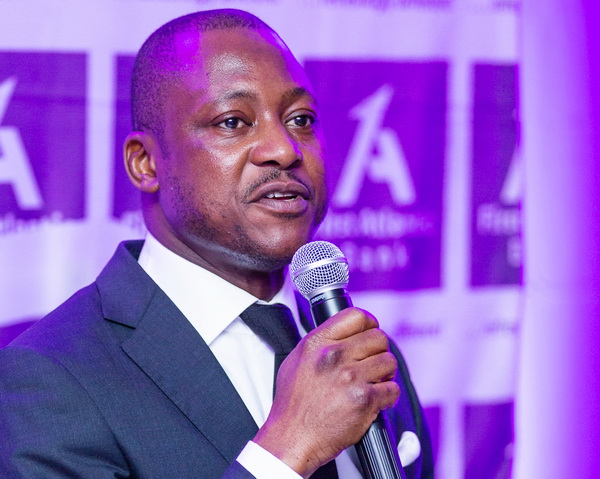

The Managing Director and CEO of First Atlantic Bank, Odun Odunfa, has assured customers that the bank’s focus to build a global bank out of Ghana is on course.

He said achieving that objective will pave the way for its internationalization across the African market and create value for loyal clients. He also commended the Bank of Ghana for taking steps to sanitize the industry.

Addressing customers and staff during a customer cocktail engagement at its Osu branch, Odun Odunfa said First Atlantic Bank is already poised to become one of the biggest banks in Ghana, with presence in six regions and 42 branch network.

He said the integration of the merged bank (First Atlantic and Energy Commercial Banks) is far advanced and should hopefully be completed before June 2019.

“So far, staff harmonization has been completed whilst products and service harmonization is almost done”, he said.

According to Odun Odunfa, First Atlantic Bank is “well capitalized way above the GHȻ400 million minimum capital requirement set by the Bank of Ghana, strong and healthy to undertake big ticket transactions with ease. We will continue to be a credible and dependable financial partner to all our customers and stakeholders. We will also continue to adhere to all the Bank of Ghana’s reforms including corporate governance and risk management directives to safeguard depositors and shareholders’ funds.

“At this moment, let me commend the Bank of Ghana for the drastic reforms in the Ghanaian banking industry which today has culminated in a very robust, sound and safe industry.”

According to Odun Odunfa, in the bank’s desire to achieve its vision of…, it has become important to enhance its capacity not only to be able to serve the needs of customers better but to be a stronger player in Ghana’s banking space.

“This involves accelerated growth, continuous repositioning to give critical attention to key needs of the retail and business banking segment of the market, expand the frontiers of E-banking and offer end- to- end banking solutions across all facets of the value-delivery process. Indeed we want to be strongly involved in improving financial inclusion by encouraging many people to save with banks. We will therefore continue to innovate and strengthen our technology to offer superior banking solutions”, he said.

According to Odun Odunfa, with mobile phone subscriptions in Ghana expected to hit about 40 million in the next two years, there is opportunity for the bank to deepen its digital banking experience to afford customers the convenience of banking comfortably from their locations.

“Our Flexipay app is a clear example of our idea of creating a financial supermarket for all bankable consumers. We will very soon outdoor our new short code (USSD) and re-introduce our Mobile Banking app to provide you with the ability to address multiple financial needs through a single, integrated channel”, he promised.

Ghanaian Economy

Quoting the World Bank, he said Ghana’s economy looks promising with GDP growth expected to be among the highest in the world at about 7.3 percent in 2019, 6.0 percent in 2020 and 6.1 percent in 2021 respectively.

“At the same time, oil production is expected to double to about 500,000 barrels per day in the next four years, whilst there are many foreign investors comprising of car manufacturers, Volkswagen, Nissan and Renault seeking to set-up production plants in Ghana.

“Your bank, First Atlantic Bank is well poised and positioned to take advantage of the numerous opportunities and provide financial solutions to the many investors seeking to do business here in Ghana. For existing businesses, be rest assured that we will continue to support you with financial solutions to develop and expand your business”, he assured.

For her part, First Atlantic Bank’s Board Chairperson, Mrs Karen Akiwumi-Tanoh re-echoed the merged bank’s promising position for its loyal customers both of the erstwhile Energy Commercial Bank and First Atlantic Bank.

“This merger positions the new First Atlantic Bank as a stronger player in the financial services sector to support your financial needs. The successful merger has resulted in an increase in our branch network making our services accessible to all our customers nationwide. Our ATM and other electronic channels have also improved convenience and accessibility to your funds and banking services.

“We also commit to maintaining our high standards of service delivery and excellent customer care across all our diverse channels.”

Source: GraphicOnline